3 Reasons Why You Need A Digital Estate Plan

Planning your estate in the past has been all about appointing your will or trust, where you would construct a will, with the help of a lawyer, to have your belongings left to one or more individuals, usually from your family, in case of your death or incapacitation. Back in the day, this was a fairly simple process, because all of your belongings were ‘real’. You would either leave a physical property such as a house, a land, a car or anything of sorts that you had owned. Also, all of your money or savings that you had was mostly in a bank or safe, where it was easily accessible once you’ve left off all of the necessary information on how to do so.

It was easier back in the day, because, all of the important documents you might’ve had we’re usually printed on paper and stored somewhere safe. It was easy and common to store all your information on back accounts, loans and other stuff in a folder and keep it safe. Once you would name the will executor, it was easily accessible by them. However, nowadays the situation is kind of different. Having a physical copy, or more precisely physical documentation, of your assets, is not that common. We live in a digital age, where most of the paperwork is now in a digital format and it’s very unlikely you have all of your digital paperwork stored in a single folder on your desktop. But, even if you did, chances are that file is password protected and you’re the only one that can access it.

Without going on all Swordfish about it, in the case of your untimely demise, it’s important to have all your digital belongings, including those documents accessible by those who you name as your successors or inheritors. This is where your digital estate plan comes in play. It is essentially your will but for your digital assets.

Digital assets can be anything that you had owned online. Your pictures and document stored on your Google Drive, your social media accounts, your credit card subscriptions, insurances, and so on. It is highly unlikely you’ve handwritten your passwords on a piece of paper and put it in your desk since that wouldn’t be as secure. So, how can you make sure all of that is accessible to others in case it needs to be? Well, for starters, you could actually write an actual inventory of all your domains, login credentials and other stuff you’d usually have safely stored on your devices.

The problem with this is, if it’s written down as a part of your will it would be seen, heard or read by people you might not want to. You might want some of your family members to have some of your estates, but not grant them access to your social media or other online stuff. If that’s the case, there are apps like OneWill that can combine all of your digital assets into one place and then you can just separately grant permission to them to whoever you wanted to.

Now, we’ve gotten familiar with the essentials of a digital estate, let’s try and see why you would want to do it. Let’s take a look at some of the reasons why we feel like having a digital estate plan would be beneficial.

1. It is easier on your loved ones

Let’s be honest, losing a loved one is a very traumatic and stressful time for anyone. There a lot of things to plan and sort out, and more often than not, if your will is lacking that can cause unwanted confusion or problems which you presumably would not want for your loved ones. It will be much easier on them to know exactly what you want to be done with your digital assets than have the debate endlessly whether your social media accounts should keep running, be memorialized or deleted. It would be great if you would construct a concise plan as to what your successors should do with each of your digital assets.

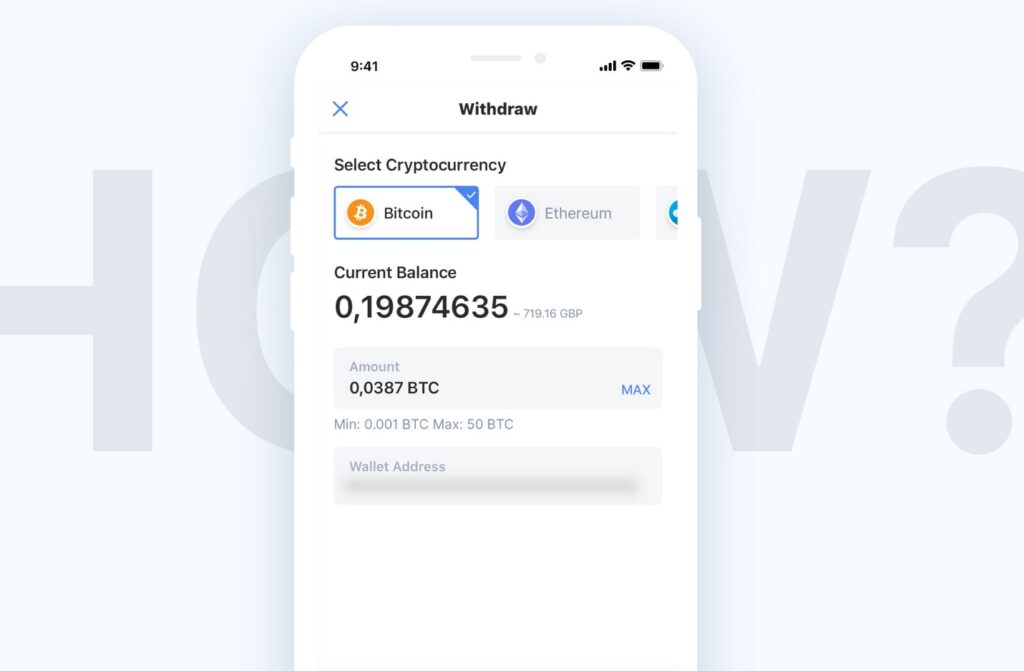

It’s not solely about having your Facebook or Instagram page shut down or frozen. You could have a lot of purchased music, books and other valuable stuff. You could have a few subscriptions that could still keep going without being used. You could have a cryptocurrency account you would want to keep running. It’s important to have all those things sorted out. Unfortunately, you never know when the third party could show up and try to claim some of your digital estates, for example, a cryptocurrency account.

2. Avoid additional costs

Before any of the instructions of the will can be carried out, a process of validation of the will must be completed. Upon the completion, the document will be issued which will confirm the validity of the will and the authority of the appointed executor of the will. This document is very important because, without it, funds or any financial assets for that matter cannot be released. This is important because, if your will is non-existent or incomplete, incoherent or there are multiple drafts that are contradicting one another, acquiring this document can be a years-long and very expensive process. Sometimes, although not often, you can even end up without the document.

3. Protecting your digital assets

People often underestimate the value of a digital asset. Let’s say you we’re a digital artist or a producer and you’ve left behind a ton of unpublished designs or music. Without a proper estate plan, almost anyone could exploit that content and make money off of your work. It doesn’t matter whether you believe it has value or not, it should be left to those you would be happy to make a profit of off it. The same thing applies for social network account, mostly Instagram. Accounts with a large following can be sold at a hefty price because of the marketing potential they possess. All of those things should be considered and properly addressed ahead of time.

Having a digital estate plan is still a fairly new thing and most of us don’t even think about it, however, considering how much of our life is actually happening online, it should definitely be on everyone’s radar sooner rather than later.