How to Get Out of Payday Loan Debt

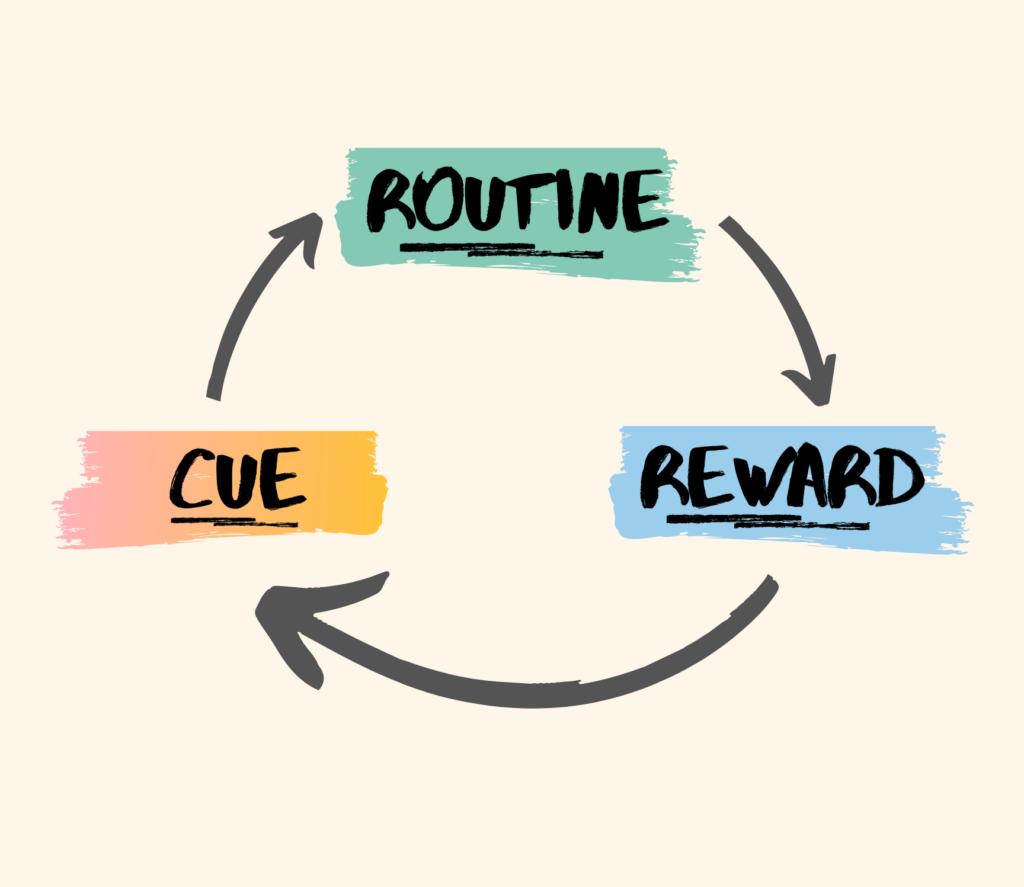

Payday loans are a great way to get fast cash without having to worry about your credit score or collateral, and they are the preferred method for easy funds to millions of people. The fact that they are so easy to get and accessible makes people believe that they are the best option and something they could use as a safety net when they are in need of extra funds. Even though all of this is true, if you don’t pay attention to your finances, you can easily get into the vicious circle of borrowing money just to be able to pay back your old loans. Here, we are going to tell you how to get out of payday loan debt, and how to protect your finances.

Change your spending habits

The first thing you need to do is prioritize. See what your spending habits are and what your current financial needs and abilities are. Think about how much cash you would need to live comfortably per month, and what you are spending the most on. If needed, consider getting a second job, or work on some short-term projects that will help you with your finances.

Consider other options

There are a lot of things that could help you in this situation, and if you cannot pay the cash back as soon as you wanted, you can think about getting more funds. You can start by talking to your friends and family members about the support they can provide and you can also start looking at other types of fundings. Personal loans along are one of the most practical things you can do, and you can also look into secure online payday loans that will help you pay back the cash you currently owe and give you time to set your priorities in order.

Talk to an advisor

Doing things alone is easier said than done, and if you have no knowledge or experience on how to handle your debt, chances are, you will start making a lot of mistakes. Most people don’t know what they can do, and they are not aware of all the options they have. To protect yourself and your future, and to find the easiest way out, you should talk to a financial advisor. Even though this would mean investing more money now, it is better to invest just a bit more for a better future.

Consider consolidation

Consolidation is the process where you get one bigger funding that will help you close all the other existing debt you have. Even though it is not the best option you have, it is still going to help you out a lot. Paying the rate of just one loan instead of several smaller ones can help you get your finances in check, and you won’t be spending too much on interests.

There are many things you can do to get out of the debt, and you should start examining which one would be the most beneficial for your specific case. Talk to people who have more knowledge and experience than you, and see what the best way forward is.